The Unspoken Shield: Navigating Death in Service and Private Life Insurance in the UK

In the quiet moments between the demands of work and the rhythms of home life, few of us care to dwell on the subject of our own mortality. Yet, the responsible management of our financial legacy demands that we do, leading many in the UK to a common, yet often misunderstood, crossroads: the distinction and interplay between an employer-provided Death in Service benefit and a privately held Life Insurance policy. These are two pillars of financial security for our loved ones, but they are not interchangeable. They serve different masters, are governed by different rules, and offer vastly different forms of protection. Understanding the architecture of each is not merely a matter of prudent planning; it is an act of profound care, ensuring that the people we cherish are shielded from both financial hardship and administrative complexity during what would be the most difficult of times.

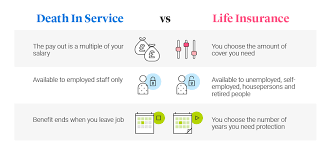

Let us first consider the Death in Service benefit, a common and valuable feature of many company pension schemes and employment packages. This is a form of group life assurance, typically offering a lump-sum payout of a multiple of your annual salary—often two, three, or four times—should you die while employed by the company. Its great virtues are its simplicity and its lack of direct cost to the employee; it is a perk of the job, requiring no medical underwriting and offering a straightforward layer of protection. However, its limitations are significant and often overlooked. This benefit is inherently transient, tethered completely to your employment status. Should you resign, be made redundant, or retire, the shield vanishes instantly, potentially leaving a dangerous coverage gap precisely when other responsibilities, such as a mortgage or dependent children, remain. Furthermore, the payout is not directed by your will; it is paid at the discretion of the pension scheme trustees, who will usually seek to distribute it to your dependants, but this process can introduce delay and lacks the precision of a will or a policy written in trust. Crucially, it is a blunt instrument, offering a one-size-fits-all sum that may bear little relation to your actual financial obligations—the outstanding mortgage, future university costs, or a partner’s loss of income—which may far exceed three or four years’ salary.

This is precisely where a private Life Insurance policy, arranged independently of your employment, establishes its indispensable role. It is the permanent, tailored, and controllable cornerstone of long-term financial planning. Unlike its employer-provided counterpart, a private policy is a contract you own, one that you design to meet your specific needs and that remains in force regardless of your career path, provided premiums are paid. You determine the level of cover—whether it is a decreasing term policy to exactly mirror an outstanding repayment mortgage, a level term policy to provide a legacy for children, or a whole-of-life policy to cover potential inheritance tax liabilities. The process of underwriting, while sometimes involving medical disclosure, locks in your insurability for the policy’s duration, a critical advantage should your health change later in life. Perhaps most powerfully, by writing the policy in trust—a straightforward legal arrangement—the payout falls outside of your estate for inheritance tax purposes and can be paid to your chosen beneficiaries swiftly, often within weeks, avoiding the probate process entirely. This offers not just financial relief but the gift of administrative simplicity during a period of grief.

Therefore, the question for the modern professional and family planner is rarely one of either/or, but of strategic integration. A Death in Service benefit should be viewed as a valuable, but potentially volatile, top-up to a robust private insurance foundation. The prudent approach is to first conduct a clear-eyed assessment of your total financial exposure: the mortgage balance, outstanding debts, income replacement needs for your family, and future educational or other legacy goals. From this total, you can deduct the reliable, long-term cover provided by your private policies. The Death in Service multiple can then be seen as a supplementary buffer, a bonus layer of security that is gratefully accepted but never relied upon as a permanent solution. This layered strategy provides resilience against life’s uncertainties—a change of job, an industry downturn, or a shift into self-employment. It ensures that the safety net for your family is not contingent on the health of your employer or the state of the economy, but is a permanent fixture of your own design. In the end, navigating this landscape is about moving from a passive hope for protection to an active architecture of certainty. It is the quiet, deliberate work of replacing ambiguity with clarity, ensuring that the ultimate act of care we perform for our families is not left to chance, but is built on a foundation that endures.